State Auditor Shad White recently released a report that detailed the costs associated with “fatherlessness” in homes and communities across Mississippi. The report attempts to correlate issues like crime, teen pregnancies and unemployment with the influence of an individual father in a child’s life.

In six pages, the state auditor tries to communicate that having “engaged” fathers in more children’s lives would not only create better individual outcomes for the children, but also save Mississippi taxpayers money. Unfortunately, the auditor’s report—regardless of his intent—is irresponsible and places blame on individuals rather than taking a hard look at systemic solutions that can help support Mississippi families and communities who face incredible daily challenges.

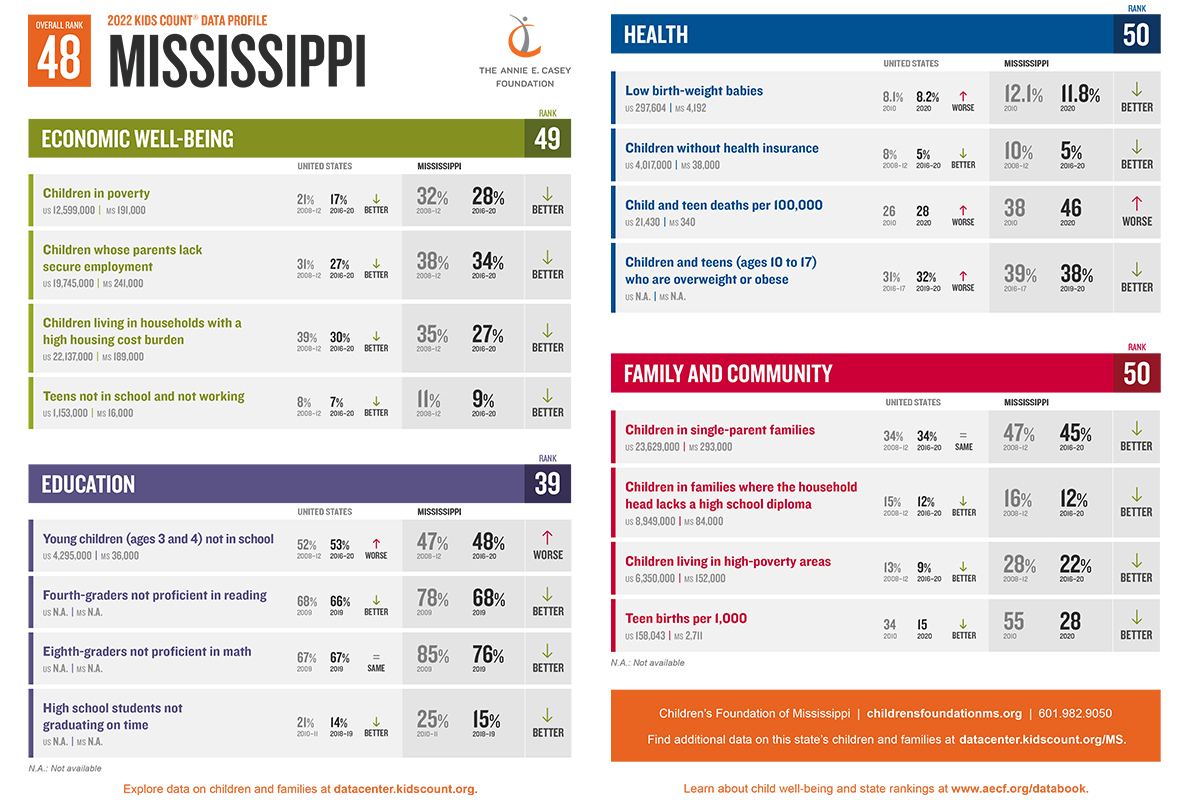

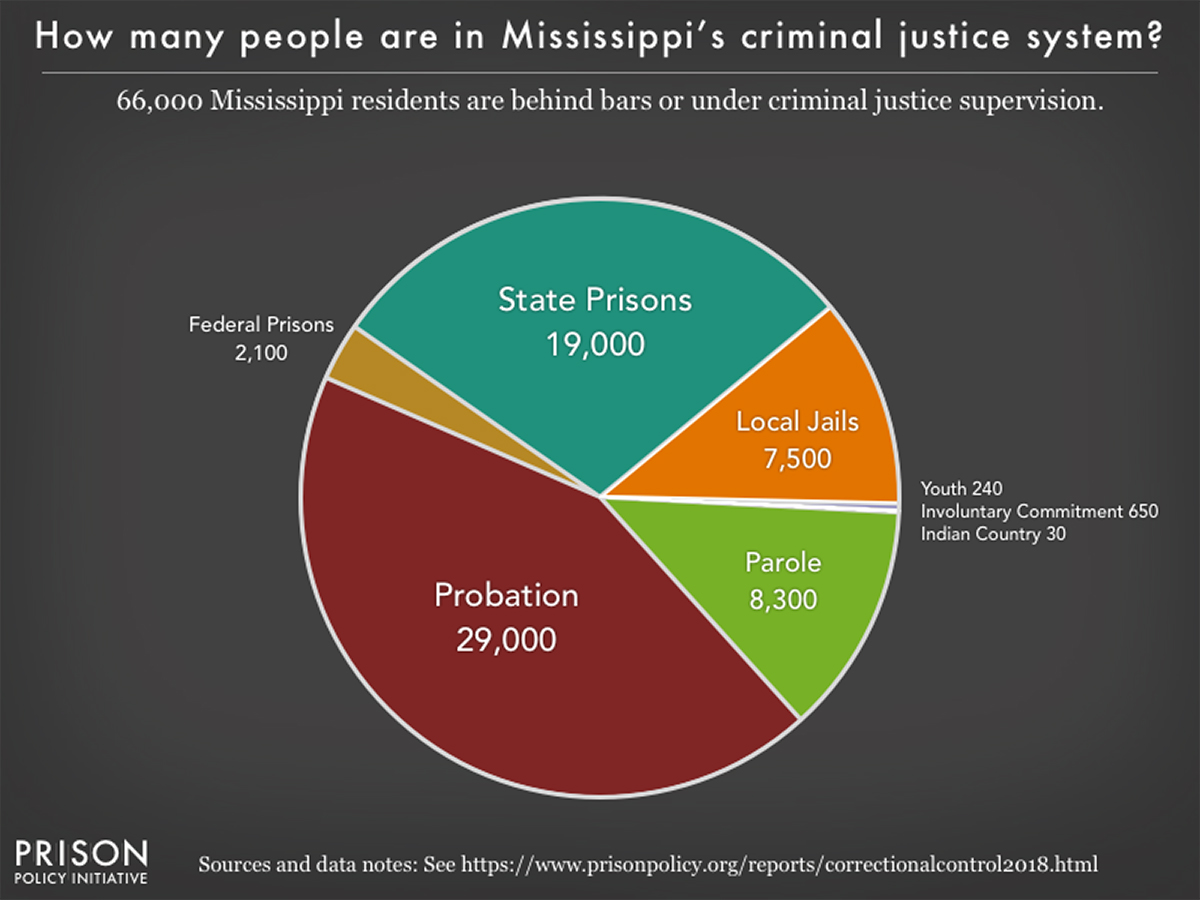

New data the Annie E. Casey Foundation released reflect that Mississippi ranks 48th overall among states in child outcomes, 49th in economic well-being and 50th in health. Currently, the United States has the highest incarceration rate in the world with approximately 437 prisoners per 100,000 people as of 2019, data from the World Population Review show. In terms of incarceration rate per 100,000 people, Louisiana, Oklahoma and Mississippi have the highest rates—680, 639 and 636—respectively.

Currently, present and former Mississippi leaders are at the center of an investigation involving TANF funds going to millionaire athletes instead of families and individuals who desperately need support. On Aug. 15, 2022, Gov. Tate Reeves ended the Rental Assistance for Mississippi Program, or RAMP, that was helping many hardworking families across the state keep up with rent payments.

Is the “fatherlessness” issue the state auditor speaks of so specific to Mississippi that it would cause the state to consistently rank at the bottom regarding child outcomes?

Is this problem so specific to the state that it would cause Mississippi lawmakers to pass laws enabling the state to incarcerate more people per capita than any other place in the world?

Did “fatherlessness” play a role in those at the center of the largest welfare scandal in Mississippi’s history?

State Leaders Should Highlight Immediate Solutions

The importance of leadership is a theme that emerges in the auditor’s report. He makes the case that young men and women make harmful decisions due to a lack of strong and consistent leaders (fathers) to guide them through life. The idea of an elected official correlating leadership and decision-making is interesting considering the role state officials play in some of the problematic issues affecting our state.

Good leaders, whether a parental figure or elected official, are solution-oriented and often self-assess before passing the blame onto others. In this case, Shad White falls short of that mark. Instead of placing the blame on a complex issue, the auditor should use his office to highlight proven solutions that create better opportunities and outcomes for Mississippi individuals and families.

The state auditor could highlight a range of resources families can take advantage of, but he chose to oversimplify a complex issue instead. Solutions like the Child Tax Credit, a tax benefit that helps families with the costs of raising children, can make an immediate impact on their lives. While the CTC has existed for more than two decades, The American Rescue Plan Act significantly expanded it in 2021.

This year, one can get up to $3,600 per child under 6 years old and $3,000 per child ages 6 through 17. The credit is less for single parents earning more than $75,000 and married couples earning more than $150,000.

Families across Mississippi are struggling to keep up with rising costs at the gas pump and in the grocery store, on top of continued obstacles resulting from the COVID-19 pandemic.

These issues are present in homes with two working parents, too.

A resource like the Child Tax Credit can provide added support to these families and improve outcomes and opportunities for children. A father may be present in the home, but if an unexpected visit to a mechanic, an urgent care or an extra trip to the grocery store causes financial stress, then those consequences will immediately affect the family.

Resources like the CTC are proven to support families, increase child outcomes and improve communities that take advantage of them.

State leaders must support Mississippi families in having better access to more vital resources.

This MFP Voices essay does not necessarily represent the views of the Mississippi Free Press, its staff or board members. To submit an essay for the MFP Voices section, send up to 1,200 words and factcheck information to azia@mississippifreepress.org. We welcome a wide variety of viewpoints.