Insurance Commissioner Mike Chaney is not sure whether Blue Cross Blue Shield or the University of Mississippi Medical Center will prevail in the ongoing reimbursement dispute that has thousands of Mississippians out of network at the state’s flagship public hospital. But with the 2023 legislative session on the horizon, he has a bill in mind to keep it from happening again.

“We will probably propose to the Legislature that contracts cannot be canceled except during an open enrollment period,” Chaney told the Mississippi Free Press in an Aug. 12 interview.

Due to the timing of the end of UMMC’s agreement with Blue Cross, individuals and employers with Blue Cross health plans must wait until November for the open enrollment period to begin, giving them the opportunity to switch from to another provider. That could mean over half a year without in-network access to UMMC.

Under the present system, the UMMC-Blue Cross dispute has left countless Mississippians out of network at UMMC’s many hospitals and clinics. While patients are still able to access care, it comes at a severely increased cost. The dispute began in February of this year when UMMC informed Blue Cross that it would not renew its agreements with the insurer, but the disagreements between UMMC and Blue Cross date back years.

Chaney said he was hesitant to expand the regulatory authority of the commission, but believes it is necessary.

“I think it’s prudent to protect the consumers of our state,” he explained to the Mississippi Free Press. “If they pay for a policy, or their employer pays for a policy, thinking that they’re in network for (UMMC) and suddenly in March, they’re not—now they can’t use the university hospital, which provides transplants, prenatal, Blair E. Batson (Children’s Hospital), infant care—as a whole line of health care. If this is an employer providing group health, their employee is out of luck.”

“And they actually purchased that policy from Blue Cross for that group plan thinking they were in network,” Chaney said.

Chaney’s proposal may simply expand the regulatory options available to the insurance commission. “(The bill may) at least give the commissioner’s office—the department of insurance—the ability to regulate how a network contract can be canceled, (limiting it) to when a policyholder has the ability to go find another carrier if they’re now out of network,” he said.

‘Voluntarily Terminated’

Chaney’s proposal comes in the middle of a deeply contentious fight between the state’s largest hospital system and its largest health-insurance provider.

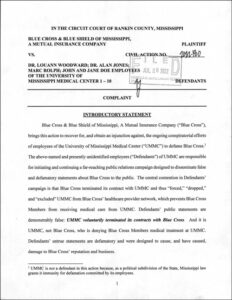

Blue Cross has initiated a lawsuit against several individual employees of UMMC for an alleged “false and defamatory public relations campaign,” both using its own communications to patients as well as information disseminated through media outlets including Mississippi Today and SuperTalk.

The lawsuit, filed July 28, targets “LouAnn Woodward, M.D., vice chancellor for health affairs and dean of the School of Medicine, Alan Jones, M.D., associate vice chancellor for clinical affairs, and Marc Rolph, executive director of communications and marketing.”

“These employees’ public statements and media campaign are that BCBSMS terminated its contracts with UMMC and thus “forced,” “dropped,” “removed,” “eliminated” and “excluded” UMMC from BCBSMS’ healthcare provider network, and that by doing so BCBSMS is preventing Blue Cross Blue Shield Members from receiving medical care from UMMC,” Cayla Mangrum, corporate communications manager wrote in part.

“In reality, UMMC voluntarily terminated its agreements with BCBSMS.”

Dr. LouAnn Woodward, Mangrum added, had written to Blue Cross in late January, informing the company of the upcoming end of the agreements between the insurer and the hospital system, marking a return to disputes that were temporarily settled in 2018. UMMC had sought increased reimbursement rates in line with other academic medical centers around the nation, which BCBS did not agree to. Previously, Mangrum explained that “there is no justification to pay UMMC more, for example, for an X-ray or bypass surgery, than it would any other Network Provider offering the same service.”

The University of Mississippi Medical Center began a public-relations offensive shortly after Woodward’s letter terminating the relationship with UMMC, reaching out to patients to warn them that “if we are unable to reach a new agreement by that date, (we) will be forced out of their network.”

In its defamation filing, BCBS charges UMMC with “ongoing conspiratorial efforts … to defame BCBS.” In the lawsuit, Blue Cross asserts that “UMMC voluntarily terminated in contracts with Blue Cross.”

Who bears responsibility for the fracture, Chaney said, “depends on who you ask. If you ask Blue Cross, they will say that UMMC canceled the contract. If you ask UMMC, they will say, well, it automatically canceled itself. We just said we weren’t going to renew it.”

Chaney called the dispute a “he-said, they said” situation, but acknowledged that “it appears that UMMC canceled the contract.”

UMMC spokesman Marc Rolph declined to comment on the ongoing dispute or lawsuit, except to state that the contract was scheduled to expire in March without a mutual agreement to extend it. Blue Cross’ Cayla Mangrum declined a request for an interview. “Due to us still being in mediation, I am unable to provide you with an interview or any comments,” Mangrum wrote in an email.

The commissioner has yet to draft the proposed bill, but Chaney may enjoy the enthusiastic support of legislative leadership in the coming session. Senate Insurance Committee Chairman J. Walter Michel, R-Ridgeland, told the Mississippi Free Press in an interview Monday that he was supportive of the idea.

“If the commissioner is coming forward with that bill, I know he’ll vet it very well. I’d be glad to support him on it,” Michel said. “It makes great sense to give people options to enroll in a different plan.”

Sen. Kevin Blackwell, R-Southaven, chairman of the Medicaid Committee and member of both the Insurance and Public Health and Welfare committees, said he would need to see a draft before he could make any commitments, but broadly agreed with the goal of restricting the timeline for major changes to network eligibility.

“I think it’s something I could support,” Blackwell said in an interview. “It would seem to make sense to (make changes) prior to an open enrollment date—that way it’s not going to be as disruptive to folks.”

Blackwell stressed that the participation of the state’s insurance providers would be a key issue in such legislation. “Obviously if we were to do something like that, we’d want to make sure we have the support of the insurance companies. I’d hate doing something that might be punitive to them,” he said.