Hundreds of thousands of Mississippians who received federal student loans could have their debt eliminated or significantly reduced under an executive order President Joe Biden announced Wednesday. The plan cancels up to $10,000 in federal student-loan debt for lower and middle-class Mississippians, or up to $20,000 for those who received Pell Grants.

“All this means people can finally crawl out from under that mountain of debt to get on top of their rent and their utilities and to finally think about buying a home or starting a family or starting a business,” the president said in a White House speech on the decision.

An Education Data Initiative analysis says that about 439,000 student borrowers live in Mississippi and owe $36,902 on average. While most of those borrowers will receive relief under Biden’s plan if they are middle or lower class, those with private student-loan debt or whose debt is for post-graduate education will not.

High-Income Individuals Not Eligible

In a tweet shortly before the official announcement Wednesday, Mississippi Gov. Tate Reeves criticized the debt-cancellation plan.

“Today Biden will announce that welders, plumbers, laborers, & other Mississippians (black, white, Hispanic, etc.) will be forced to pay off the debts of Harvard doctorate degree gender studies majors living in California,” Reeves tweeted. “Why does the Democrat Party hate working people so much?”

The governor’s tweet is misleading, however. Under the plan, single borrowers will only be eligible for debt cancellation if their income is less than $125,000 or under $250,000 for married couples. In a fact sheet today, the White House said the U.S. Department of Education “estimates that, among borrowers who are no longer in school, nearly 90% of relief dollars will go to those earning less than $75,000 a year.”

While Rep. Bennie Thompson, D-Miss., called the student-loan relief plan “a step in the right direction,” other Mississippians in the U.S. House and Senate greeted the news with displeasure.

“Plenty of hard-working Americans chose not to pursue a college education or worked their way through college to pay for their education,” tweeted Republican U.S. House Rep. Michael Guest, who represents Mississippi’s 3rd Congressional District. “These tax-paying citizens will be the ones paying for Biden’s $300-billion payout. There is nothing fair about this.”

Republican U.S. Sen. Cindy Hyde-Smith referred to the plan as an “inflationary student loan forgiveness scheme” that “will cost hard-working Americans more than $300 billion.”

“So much for deficit reduction,” she tweeted. “Legal challenges to this unfair decision are inevitable.”

Moody’s Analytics Chief Economist Mark Zandi disputed the idea that the debt-relief program will cause more inflation, however, Reuters reported. The government has had student-loan payments on pause since the COVID-19 pandemic began in 2020. Biden announced plans to extend the moratorium on payments “one final time through December 31, 2022.” After that, borrowers “should expect to resume payment in January 2023.”

“Some have expressed concern that these moves will fan higher inflation. Not so,” Zandi said. “Just the opposite. The end of the moratorium and targeted debt forgiveness will result in the resumption of billions per month in student-loan payments. This will restrain growth and is disinflationary.”

Plan Caps Monthly Payments

Once payments resume in January 2023, Biden’s plan will cap monthly payments at 5% of discretionary income, down from the current 10% cap. The White House fact sheet says this will guarantee “that no borrower earning under 225% of the federal poverty level—about the annual equivalent of a $15 minimum wage for a single borrower—will have to make a monthly payment.”

The fact sheet says the order would also “cover the borrower’s monthly interest, so that unlike other existing income-driven repayment plans, no borrower’s loan balance will grow as long as they make their monthly payments—even when that monthly payment is $0 because their income is low.”

The White House offered several hypothetical scenarios for how the order will affect borrowers when payments resume. “A typical single public school teacher with an undergraduate degree (making $44,000 a year) would pay only $56 a month on their loans, compared to the $197 they pay now under the most recent income-driven repayment plan, for annual savings of nearly $1,700,” the fact sheet explained.

“The skyrocketing cumulative federal student loan debt—$1.6 trillion and rising for more than 45 million borrowers—is a significant burden on America’s middle class,” the White House said. “Middle-class borrowers struggle with high monthly payments and ballooning balances that make it harder for them to build wealth, like buying homes, putting away money for retirement, and starting small businesses.”

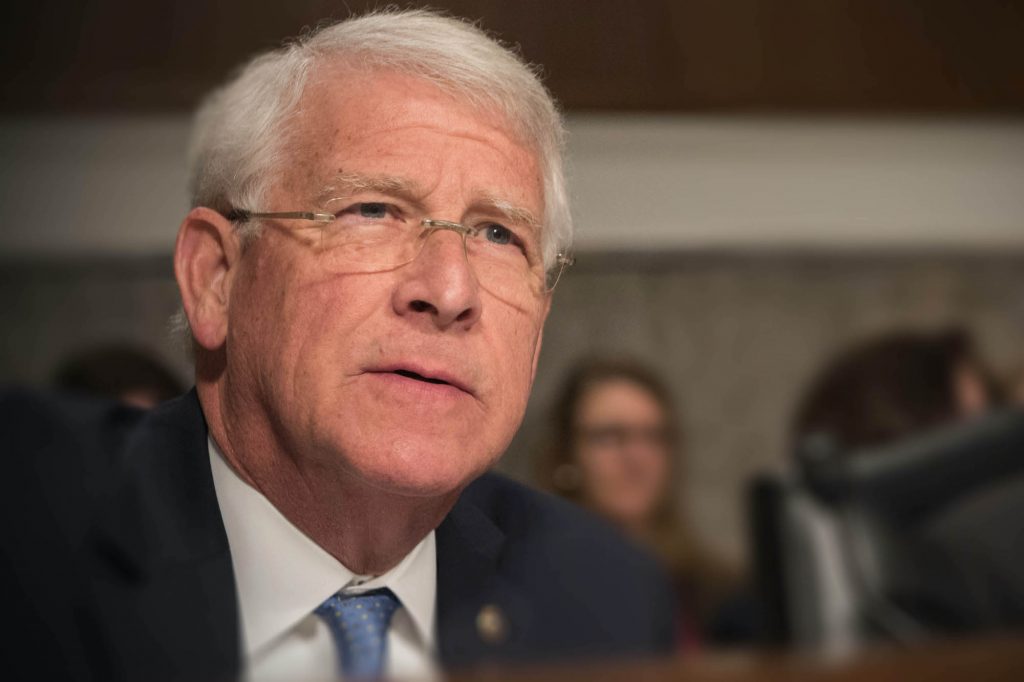

In a statement Wednesday afternoon, U.S. Sen. Roger Wicker, a Mississippi Republican, joined his party’s chorus, saying that Biden’s “unilateral action today is unfair to the majority of American taxpayers.”

“Instead of tackling the inflation that is affecting us all, President Biden has chosen to advance the interests of a select few who knowingly took on student loan debt. Many Americans have taken a different path to avoid student loan debt—for example, serving in the military or pursuing a different career option,” the senator said. “The president’s action takes their hard-earned tax money and gives it to those who made financial decisions that the president favors. This is deeply unfair.”

The “select few” Wicker referenced includes about 43 million Americans who will be eligible for at least $10,000 in student loan debt cancellation. The White House fact sheet estimates that the relief plan could cancel all remaining federal student-loan debt for nearly half of them, or about 20 million.

Like Hyde-Smith, Wicker raised the possibility of a lawsuit.

“The President’s action is also potentially illegal and will almost certainly invite legal challenges,” Wicker said. “President Biden is testing the outer limits of his authority and could soon face a reality check in court.”

In his remarks Wednesday, though, Biden said he was canceling student-loan debt “using the authority Congress granted to the Department of Education.”

Several of the Mississippi leaders criticizing the student loan debt forgiveness plan have benefitted from federal loan forgiveness recently. Federal data show that Southern Air Conditioning Supply, Inc., a Pearl, Miss.-based business that the governor partially owns, received $191,217 in PPP loan forgiveness in the COVID-19 era. Coker & Palmer, an insurance company where Reeves’ wife, Elee Reeves, works as a financial advisor, received $346,256 in PPP loan forgiveness.

On Facebook Thursday, Sen. Chris McDaniel, R-Ellisville, lamented that “taxpayers who never went to college are now being forced to pay for other people’s college debt.” But federal data show that the Laurel, Miss., law firm he is a partner at, Hortman, Harlow, Bassi, Robinson & McDaniel PPLC, received $418,527 in forgiveness across two PPP loans since last summer.

NAACP: ‘A Devastating Political Mistake’

Not all the president’s critics for the student-loan relief plan come from the right. After news that Biden planned to cancel $10,000 in student loans for borrowers making under $125,000 broke Tuesday, NAACP President Derrick Johnson and NAACP National Director of Youth & College Wisdom Cole wrote in an op-ed for CNN that the move “would do little to help” and “would be bad public policy and a devastating political mistake.” Johnson is from Mississippi and previously led the Mississippi NAACP.

“Black Americans have been disproportionately devastated by student loan debt,” Johnson and Cole wrote. “Four years after graduating, they hold an average of almost $53,000 in debt, almost double the $28,000 average White Americans hold. And they typically end up owing 5% more than they initially borrowed, while white borrowers owe 10% less. Canceling just $10,000 of debt is like pouring a bucket of ice water on a forest fire. It hardly achieves anything—only making a mere dent in the problem.

“Biden must recognize and regard student debt as a racial and economic justice issue. Canceling $50,000 or more per borrower would free millions of Americans, allowing them to become more active participants in the U.S. economy.”

Mississippi has the most Black residents per capita of any state, with Census data showing that about 38% of Mississippians are Black. The state also has the nation’s highest poverty rate, which disproportionately affects Black residents. In 2017, Mississippi had the nation’s highest default rate for student loan borrowers 15.2%, compared to the nation average of 9.7%.

The NAACP op-ed published before the White House announced full details on the plan, such as the cancellation of up to $20,000 for pell-grant recipients. In its fact sheet, the White House said the cancellation will “advance racial equality,” partly because of its focus on pell-grant recipients.

“By targeting relief to borrowers with the highest economic need, the Administration’s actions are likely to help narrow the racial wealth gap,” the fact sheet said. “Black students are more likely to have to borrow for school and more likely to take out larger loans. Black borrowers are twice as likely to have received Pell Grants compared to their white peers. Other borrowers of color are also more likely than their peers to receive Pell Grants. That is why an Urban Institute study found that debt forgiveness programs targeting those who received Pell Grants while in college will advance racial equity.”

In 1980, Pell Grants covered almost 80% of the cost of a four-year college, but federal assistance has not kept pace with rising college costs. Today, Pell Grants covered only about a third of the cost.

The White House fact sheet says that Pell Grant recipients represent over 60% of student loan borrowers and that about 27 million people who received Pell Grants will become eligible for up to $20,000 in relief.

“All this means people can finally start crawling out of that mountain of debt,” Biden said during remarks at the White House on Wednesday afternoon. “When this happens, the whole economy is better off.”