Mississippi Republicans in the U.S. Senate and House of Representatives have made numerous misleading claims about the Inflation Reduction Act, a bill President Joe Biden signed into law on Tuesday that will have sweeping effects on climate, health care and tax issues nationwide.

The legislation includes $369 billion aimed at reducing greenhouse gas emissions, boosting the adoption of renewable energy and cleaning up pollution. Other provisions in the bill could help reduce health-care costs by allowing Medicare to negotiate drug costs and increasing subsidies for Affordable Care Act enrollees.

Mississippi’s two Republican U.S. senators and three Republican U.S. House representatives all voted against the bill. Rep. Steven Palazzo, who represents Mississippi’s 4th Congressional District, called it “out of touch legislation.” Rep. Michael Guest, who represents the State’s 3rd Congressional District, described the bill as a “destructive piece of legislation.” Both men joined Rep. Trent Kelly, who represents the state’s 1st Congressional District, to vote against the bill.

Only Rep. Bennie Thompson, Mississippi’s lone Democrat in Congress, voted for the Inflation Reduction Act on Aug. 12. In a tweet that day, he praised it as “a historic bill to lower health care costs, cut prescription drug prices, and lower the price of energy.”

Senate Democrats attempted to amend the bill to cap insulin costs for diabetics on the private market at $35 per month, but most Republicans, including U.S. Sen. Roger Wicker of Mississippi, successfully voted to block the amendment. Mississippi’s junior U.S. senator, Cindy Hyde-Smith, was one of just seven Republicans who voted for the insulin cap, although she later voted against the overall bill.

Electric Car Tax Credit Not For The Rich

In a statement on Aug. 6, Sen. Hyde-Smith claimed that the legislation’s “radical climate agenda” includes giving “tax breaks to wealthy Americans to buy electric vehicles and kitchen appliances.”

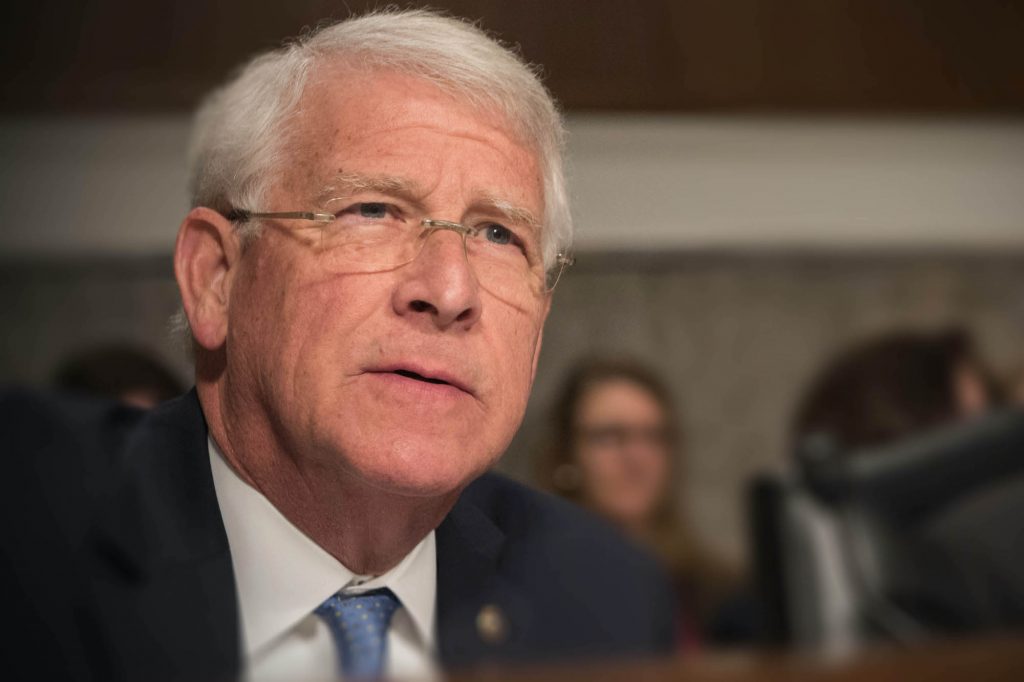

Sen. Wicker similarly criticized the bill for including “$250 billion in tax revenue on wasteful subsidies that would largely benefit the wealthy,” referring to the bill’s extension of a tax credit for electric vehicles.

“This is an obscene form of socialism for the rich—taking money from middle class taxpayers and giving it to high-end car buyers,” Mississippi’s senior senator said in a statement on Aug. 7.

In fact, the $7,500 electric vehicle tax credit is only available to individuals making a gross adjusted income of $150,000 or less or married couples making $300,000 or less. The credit also cannot be used to buy the most expensive electric cars. Buyers cannot claim the credit on electric sedans that cost more than $55,000 or on SUVs, vans or trucks that cost more than $80,000.

Under the Inflation Reduction Act, buyers can also claim a tax credit on used electric vehicles that are at least two years old. The used electric-vehicle credit is 30% of the vehicle’s cost or up to $4,000, depending on which is less.

However, some critics of the legislation who support the idea of electric vehicle credits generally have warned that many electric vehicles could become ineligible due to the bill’s sourcing and final assembly requirements. The U.S. Department of Energy provides a list of 2022 and 2023 year-model electric vehicles that are eligible for the tax credit.

The ‘Army of 87,000 IRS Agents’ Claim

In her Aug. 6 statement, Sen. Cindy Hyde-Smith claimed the Inflation Reduction Act “spends $80 billion to make the Internal Revenue Service one of the largest federal agencies in history, with 87,000 additional IRS agents to audit Americans in order to find revenue to pay for the bill.” Rep. Michael Guest, the Republican who represents Mississippi’s 3rd Congressional District, claimed during a speech on the U.S. House floor earlier this month that the act “will add an army of IRS agents.”

Their claim about IRS agents is one that Republican leaders across the country have made repeatedly since Democrats unveiled the bill this summer. U.S. House Minority Leader Kevin McCarthy, R-Calif., claimed that Democrats are sending a “new army of 87,000 IRS agents … with 710,000 new audits for Americans who earn less than $75k.”

In a fact check on Aug. 10, the Associated Press called such remarks “misleading,” noting that the U.S. Treasury Department announced a plan to hire about 87,000 new IRS agents last year, long before the Inflation Reduction Act emerged.

“But those employees will not all be hired at the same time, they will not all be auditors, and many will be replacing employees who are expected to quit or retire, experts and officials says,” the AP reported.

The bill itself does not mandate the hiring of 87,000 new IRS agents. It does increase funding for the IRS, which has lost about 30% of its staff since 2010 as Republicans demanded cuts to government agencies. Natasha Sarin, the U.S. Treasury’s counselor for tax policy and implementation, told the AP earlier this month that the new funding will “boost efforts against high-end tax evasion.”

The most audited county in the nation at present is Mississippi’s Humphreys County, which is 76% Black and, with a 33% poverty rate, is one of the poorest counties in the country. More than half of its residents claim the earned income tax credit, a program intended to help boost low-income workers out of poverty. In an investigation of IRS auditing practices, ProPublica reported that “the IRS audits EITC recipients at higher rates than all but the richest Americans” in “response to pressure from congressional Republicans to root out incorrect payments of the credit.”

Raising Corporate Taxes

On Aug. 12, Rep. Steven Palazzo used Twitter to claim that “Democrats are raising your taxes and beefing up the IRS” and told voters to “think again if you think these aren’t correlated.” During his House floor speech earlier this month, Rep. Michael Guest said the Inflation Reduction Act will “increase taxes on Americans.” In his Aug. 7 statement, Sen. Roger Wicker called it “a $313 billion tax on job creators and manufacturers.”

Other Republicans have similarly claimed the new law will raise taxes on working-class Americans, which, if true, would break President Joe Biden’s campaign pledge not to raise taxes on anyone making less than $400,000. However, the act does not raise taxes on any individuals or families.

Instead, the Inflation Reduction Act raises corporate taxes with a mandated 15% minimum tax rate on corporations and a 1% fee on stock buybacks that will affect wealthy corporate executives. While their tax rates will remain unchanged, a Joint Committee on Taxation report says that people who make under $400,000 could experience indirect effects from the corporate tax increases due to price increases or lower wages.

Over $300 Billion In Deficit Reduction

Sen. Hyde-Smith called the Inflation Reduction Act a “$740 billion package,” and Rep. Guest described it as a bill that will “spend hundreds of billions of taxpayer dollars on far-left priorities.” Other Republicans have similarly described it as a “spending bill” or highlighted its costs.

But that emphasis obscures the fact that the overall package will reduce, rather than increase, the yearly national deficit. That’s because, despite the fact that it includes about $437 billion in spending, estimates show it will raise about $737 billion in revenue, reducing the deficit by over $300 billion.

The Joint Committee on Taxation estimates that the 15% corporate minimum tax will raise $222 billion and that the 1% stock buybacks fee will raise $74 billion; the Senate estimates that its drug pricing reforms will raise $265 billion; and the Congressional Budget Office estimates that increased IRS tax enforcement on high earners will raise $124 billion.

‘False Advertising’

In his Aug. 7 statement, Wicker cited a Moody’s Analytics report that found the Inflation Reduction Act would cut inflation over the next decade by just 0.33%. “Calling this bill the ‘Inflation Reduction Act’ is false advertising,” Wicker said.

Economic experts that NPR’s Juliana Kim interviewed earlier this month agreed that the Inflation Reduction Act will likely only have a modest impact on inflation over the long term, with little effect in the short term. Inflation is currently at a 40-year high, though inflation did show some signs of deceleration in July.

U.S. Sen. Joe Manchin, a moderate Virginia Democrat, made a promise to reduce inflation a key to securing his vote for the overall package and its climate and health-care provisions.

As he signed the bill into law on Tuesday, President Biden called it “one of the most significant laws in our history.”

“We’re cutting the deficit to fight inflation by having the wealthy and big corporations finally begin to pay part of their fair share. … My fellow Americans, that’s the choice we face: We can protect the already-powerful or show the courage to build a future where everybody has an even shot.”